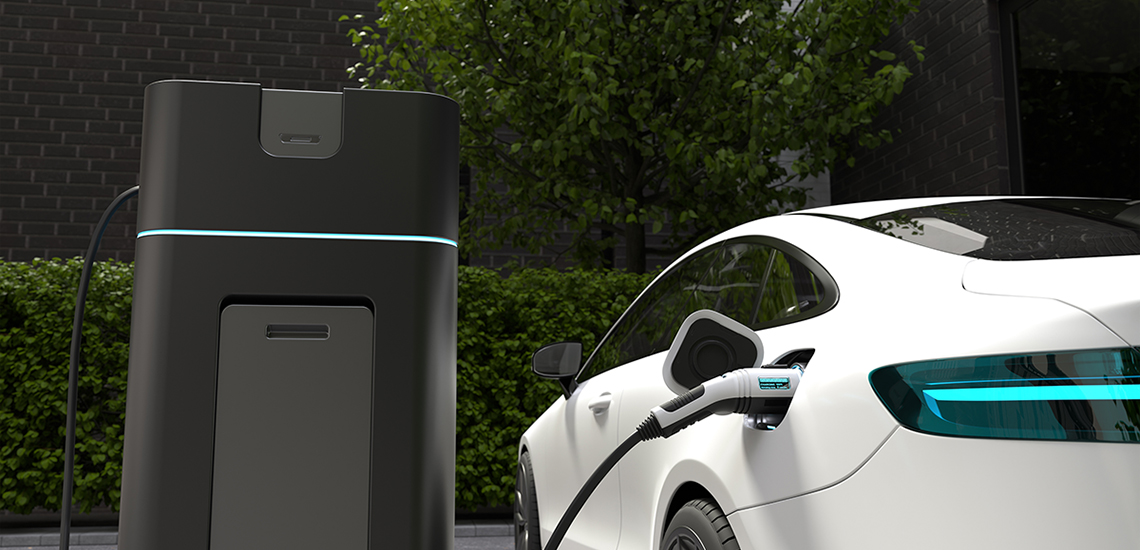

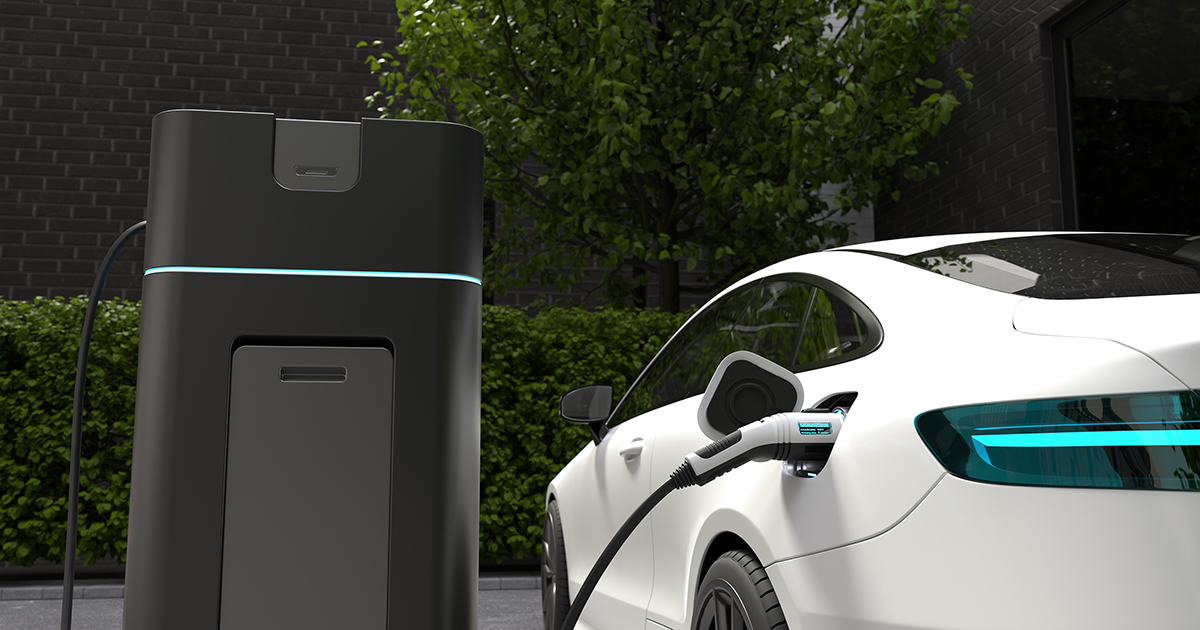

A Pre-Owned Electric Car on Credit from OTP BANK — A Smart Choice for Those Who Know the Value of Money

JSC «OTP BANK» offers favorable financing conditions for those who want to get behind the wheel of a modern and reliable pre-owned electric vehicle without overpaying for the loan. A reduced interest rate is a strong argument in favor of purchasing an eco-friendly car with the Bank’s support, says Vitalii Skorobohatyi, Head of Automotive Lending Development at OTP BANK.

“A used electric vehicle on credit is not only about the opportunity to own a car today and enjoy the comfort — it’s also a smart investment in the future. At OTP BANK, we’ve created conditions that truly make this choice easier for our clients: a reduced interest rate, a minimal down payment, no CASCO insurance or vehicle age requirements. This means you can buy an electric car quickly, without hidden fees or excessive bureaucracy. We’re proud to support customers who choose sustainable solutions,” noted V. Skorobohatyi.

Key terms for OTP BANK’s used EV financing:

- Annual interest rate — 25.99%

- Down payment — starting from 10%

- One-time commission — 2.99%

- Loan amount — from UAH 10,000 to UAH 1,000,000

- Loan term — from 1 to 7 years

- Effective annual rate — from 30.78% to 37.22%

Buying an electric vehicle is not only about environmental responsibility and sustainable development. It also brings numerous benefits to the owner. EVs combine cutting-edge technology that ensures a smoother, quieter driving experience compared to conventional vehicles — plus significant savings on fuel and maintenance.

How to quickly calculate your loan amount?

You can estimate your financing amount in just one minute using the easy-to-use chatbot or calculator on the OTP BANK website. Bank specialists will provide a detailed consultation and help you choose the optimal loan term and monthly payment plan.

The Bank provides a final financing decision and transfers the funds for the vehicle within one business day.

Reminder: OTP BANK offers loans from UAH 10,000 to UAH 1,000,000 for any pre-owned vehicle. With the Bank’s support, you can also become the owner of a brand-new car from a dealership. And since motorcycle season is in full swing, the Bank has prepared special loan terms for clients interested in financing a motorcycle purchase as well.

Share these news with friends!

Public Joint Stock Company OTP Bank is a subsidiary of OTP Bank, which is the largest independent Central-Eastern-European banking group. JSC OTP Bank is one of the largest domestic banks, a recognized leader in the financial sector of Ukraine. The Bank provides a full range of financial services to corporate and private customers, as well as to small and medium enterprises. The bank entered the Ukrainian market in 1998, and since then it enjoys a staunch reputation of socially responsible, reliable and stable institution providing its consumers with services of European quality standard.